The best primary market research method depends upon your research goals. So, if you a conducting a political poll, a survey is best. But, if you are looking for customer feedback on software features, a research interview methodology is best.

The most important step in choosing the right methodology and scope is to set your goals. This includes understanding the following:

- Is primary research necessary? Sometimes secondary research is OK

- Are you selling a simple product or service, or customized services?

- Do you need quantitative data or in-depth insights?

- Are you measuring something simple such as favorite candidate?

- Are you looking for market share, lost sales or to understand your current customer?

- Are you looking for competitor data or to know more about your target customers?

Collect Useful Data

Regardless of your data targets, your research data targets must be clear, actionable and accurate. And beware of interesting, but ineffective data.

Primary market researchers are curios people and want to find interesting information. Make sure you stay engaged so the research methods and surveys target useable information.

Hire a Professional

Think of market research like dental hygiene. You should brush your teeth every day AND visit a dentist every 6 months.

The same is true of market research. Your team should be in constant contact with your customers. AND you should hire a primary market research firm every 6-18 months to make sure your internal research is giving unbiased results.

Primary Market Research Methodologies

Once your objectives are defined, the right methodology becomes clear. Some general guidelines for choosing the right Primary market research types are:

- Qualitative Research– Use for abstract concepts such as custom solutions and discovery research

- Quantitative Research – Best for competitor benchmarking, measuring consumer perceptions and opportunity measurement.

- Lean Startup – Most effective for product and market features for fast moving markets such as software and fashion

- Transaction Data – Best for hard statistical measures such as market share, opportunity identification and the effect of marketing activities.

- Comprehensive Studies – The use of multiple types of research to provide a full definition of a marketplace

Qualitative Research

Qualitative primary market research is used to gather information on complex subjects. Most qualitative primary market research uses interviews and focus groups. The most common is to collect data on complex topics. Qualitative resaerch is also used for exploratory research and survey design.

A focus group tends to collect more complete insights. Interviews tend to be faster but lack the depth of data collection that focus groups offer. Both provide the best conducted by a professional using a semi structured interview process.

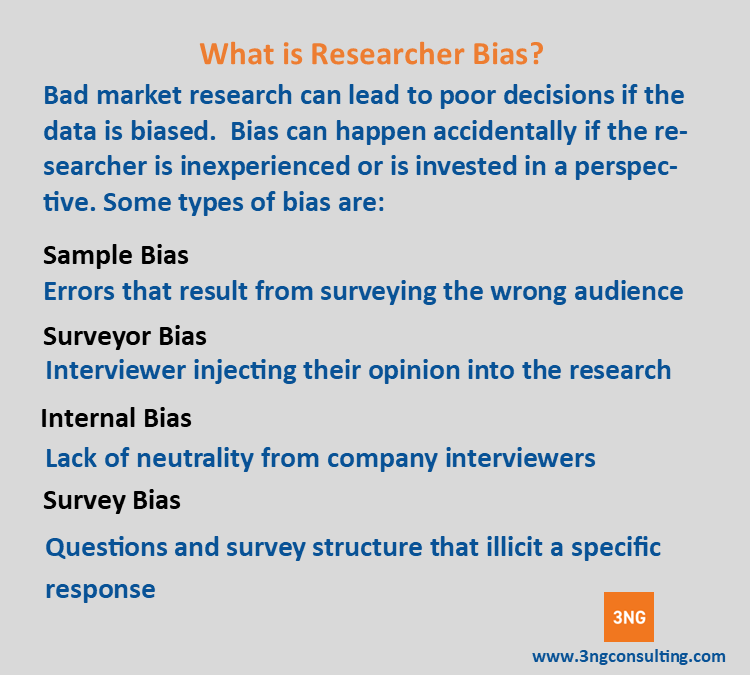

The moderator is key to the quality of data you receive. Ideally, you need experienced researcher who is knowledgeable about your market but is not invested in a particular concept.

Quantitative Research

Quantitative research collects statistical data to help make business decisions. Quantitative research should provide actional market data. Some typical data points include market size, customer needs and strategy effectiveness.

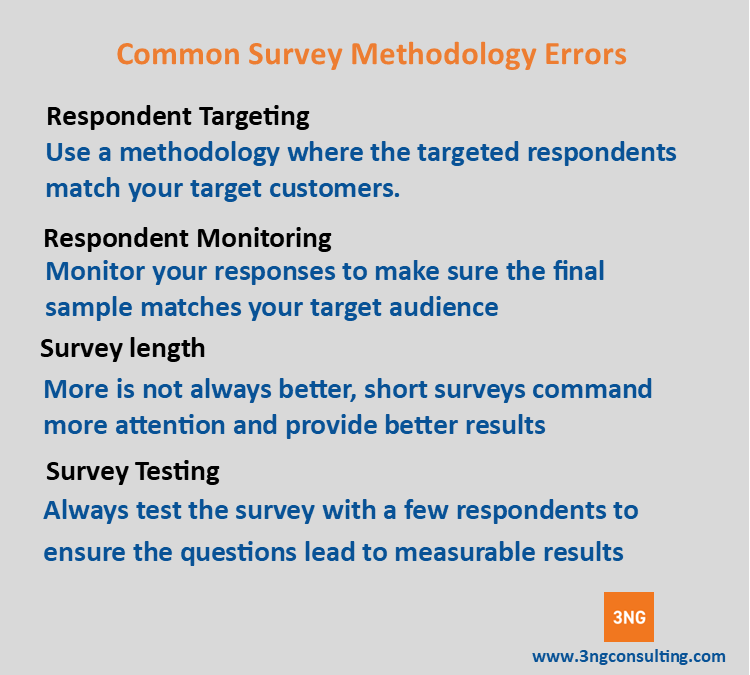

The keys to good quantitative research are well-designed surveys, good sampling and the right data collection process. Bad survey methodology can result in bad data and risky business decisions.

A frequent error in quantitative research is sample bias in online surveys. To avoid this, make sure you target the right audience, monitor survey respondents and adjust as needed.

Transaction Data

Transaction data research uses sales data to predict future demand. Transaction data can come from internal systems or be bought from vendors, or both. Transaction data is often used to measure market share, identify market opportunities and set pricing.

Transaction data is an exciting new field. The advent of AI is helping companies improve respond to market changes almost immediately. So, instead of periodic pricing studies, AI tools can provide instant results. And, if used well, instant changes can be applied.

Also, combining transactional data is with quantitative research helps create broad and deep insights.

Lean Startup

The lean startup methodology combines product development and market research. In this process, small features are added and tested the target market. This allows the company to collect instant customer feedback and abandon ineffective features quickly.

Using this process can be much more cost effective than traditional market research since it reduces IT development resources.

Comprehensive Studies

Every market study is unique. And primary research methodology may not provide full results. For example, a company looking to enter a new software market might be best served by:

- Using qualitative market research to understand the competition and customer needs

- Qualitative market research to quantify how satisfied the competitors are with the competitors

- A lean startup process to bring the product to market.

Keys to Successful Market Research

There are some keys to success when conducting primary research. These are:

- Define your scope

- Make sure your market segmentation is correct

- Use a qualified third-party vendor

- research the researcher

- Do periodic data quality checkpoints

- Make sure the actionable targets are relevant

About 3NG Consulting

Our business philosophy is to know your market before you make decisions. So, we recommend you use ongoing regimen of primary market research to stay on target.

Not all engagements require an expensive research study, some only require small studies or may be contained in our data library. Some other data can be held in government databases such as the BLS.

Our team will take the time to understand your needs and recommend the best method for your business. So, if growth is stagnant or you want information on a new market. We can help you get the data you need.