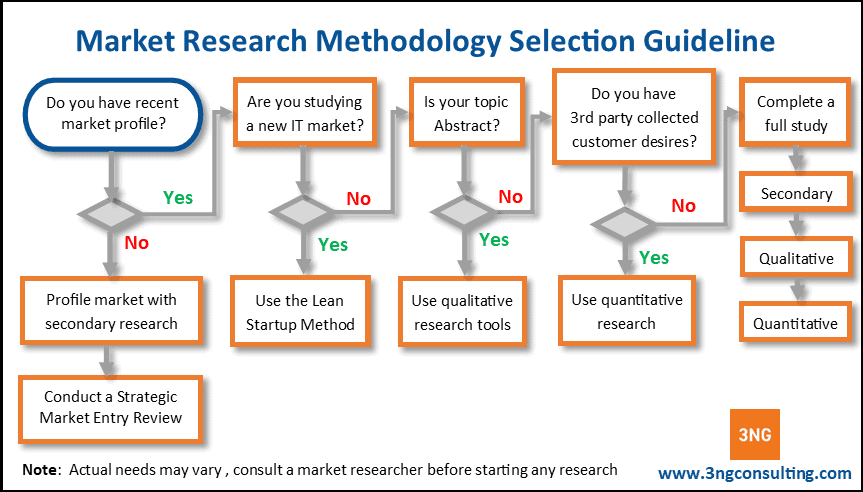

Research is a powerful tool if collected and used properly. Deciding how to collect and use is the key to any market research strategy.

As a guide, your company should use quantitative research whenever possible and qualitative research when statistical data cannot be collected. The first step in making a decision is understanding the difference and the value between the two.

- Qualitative Market Research: focuses on interviewing current and potential customers for in-depth insights.

- Quantitative Market Research: collects behavior patterns using survey and transactional data.

For example, a grocery store owner talking with customers about snack foods is qualitative market research. And a survey that asks customers if they prefer potato or corn chips is quantititive market research. So, the store owner will learn a lot about snack foods from the conversation and collect data from the survey.

The Basics of Market Research

Start with a Research Plan

The first step in marketing research is to define the problem and market plan. From there, identify your target data, audience and goals before you get started. This will show if you need quantitative or qualitative market research.

Use Neutral Third Parties

Competent people believe in their own ideas and may reject different opinions. So, hire a researcher who will listen to ideas instead of reinforcing current thoughts.

Spend Time on your Survey Questions

Garbage in garbage out is common. Hire someone who knows how to build the right Market Research plan for your needs.

Always Test Your Surveys

A small test with a few targets confirms the quality of your survey. Skipping this can result in a wasted money and bad results.

Identify your Target Market

A common market research mistake is talking to the wrong people. So, identify your buyer personas before you send surveys.

Secondary Industry Research

Secondary market research melds available data into a targeted report. This can include data from surveys or data companies.

Primary market research is collected for a specific project. Primary research data is more complete than secondary research data. But secondary market research can be useful and cost effective.

For a secondary study, industry Researchers search available data to build a profile. This is the most common form of qualitative data collection. And while it provides good data, and shows market trends, it can have data gaps.

Secondary research is most effective to guide further research. However, quality matches the primary research and isn’t exact to your needs. As a result, companies should be smart about using secondary research for decisions.

Defining Qualitative Market Research

Qualitative market researchers interview customers and potential customers. This is most commonly done with live interviews, focus groups or web meetings.

The purpose of qualitative research is to collect a deep understanding of customer needs for strategic research insights. Qualitative research is the best way to get data on abstract or complex services.

Qualitative research is also the foundation of the “Lean startup” model. Software companies commonly use this type of quantitative research. In this process, a research services company tests small product features to ensure the process is headed in the right direction.

Defining Quantitative Market Research

Quantitative market research captures hard data. This is done with market surveys where customers rate ideas and attributes. In general, quantitative research is best for measuring purchase intent, customer satisfaction and customer needs.

And methods such as Conjoint Analysis and forced rankings collect high quality predictive data.

The two keys to quantitative market research are survey design and data sampling. Your survey should be clear, and respondents should match your target audience as closely as possible.

Constant adjustments during the survey process are key to good data sampling. In most cases, you will need to adjust survey targeting. Items like gift cards and cash incentives help balance your audience.

Survey approach also matters. For example, senior citizens are best polled via landline. And young people are best reached via SMS, social media or online surveys.

Transactional Data Resources

Social media and search engines offer great new options. Services such as Google Analytics, Google Search Console and Google Trends are great for tracking internet traffic. Social media are also great data sources. Their tools monitor behavior and can help show market patterns.

There are also independent providers such as SEMrush who have tools for content marketing solutions.

And since they transactional data offers real customer patters, the information is high quality and very actionable.

Build Data Quality with Market Research

Strategic market research is a tool. And like all tools, it must be used properly. Some keys to collecting and using data are:

- Build your Strategy: decide what data you need.

- Eliminate bias: Hire an expert and remove your team from the research.

- Collect Primary Data: Free studies often lack precision. So, hire an expert firm to collect the data you need.

- Use the Right Methodology: Use qualitative data for abstract ideas and quantitative data for clear ideas

- Conduct Experimental Research: Always test and adjust your study for quality results.

- Watch your Sampling: Make sure your audience matches your target customers

- Determine your Sample Sizes: Collect the right number of surveys to form conclusive results

- Refresh Your Data Often: Markets change, so cycle your study to make sure the data stays fresh

- Use Multiple Sources: Check your data against other studies and market data.

Market Research FAQs

How does qualitative research differ from quantitative research?

Qualitative data offers deep insights while quantitative data offers numerical data. So, a qualitative study offers different perspectives. Quantitative data uses descriptive statistics to tell how many people agree with each perspective.

How do you present qualitative data in a report?

Presenting qualitative data is all about context. Because the data is not statistical, the meaning is not obvious and must be shown. Some of the best tricks for adding meaning are:

- Showing the credibility of the data source

- Grouping similar data points.

- Showing the data with graphics.

What are some innovative market research methodologies?

Innovative quantitative research methods are mostly in the area of data collection and analysis. Some of the newer methods are:

- Real time surveys that pop upon your web site

- Social media, SMS and embedded surveys

- AI based survey analysis tools

- AI based data mining tools

What are some online research tips for beginners?

The most important tip for beginners is keep it simple and be open minded. You want to get information from customers that will help your business.

So, ask direct questions, send short surveys and use easy research tools. After you have completed a few surveys, then do long surveys with advanced techniques. One of the best market research tools for beginners is SurveyMonkey.

Which marketing research data might be inaccurate?

Any market research data can be poor quality if done badly. Fortunately, there are easy ways to avoid bad data. The keys are:

- Look at the audience. A political poll on a politically leaning website will have bias.

- Read the survey: Leading questions will capture an inaccurate response

- Look at the audience size: A survey that has less than 30 responses may not be useful

- Know the surveyor: Internal company interviewers collect less reliable data than neutral third parties.

- Understanding the Purpose: Make sure the reason for the survey matches your needs.

How do focus groups work?

Focus groups are interviews with small groups of people. Focus groups bring a small group into a purpose built room.

A moderator then asks questions of the group about a set of topics. The responses are recorded, and the data is presented in a report.

Focus groups capture good qualitative insights. They are often used to collect customer experiences in for a survey. Focus groups can also be used for understanding abstract ideas and user workflows.

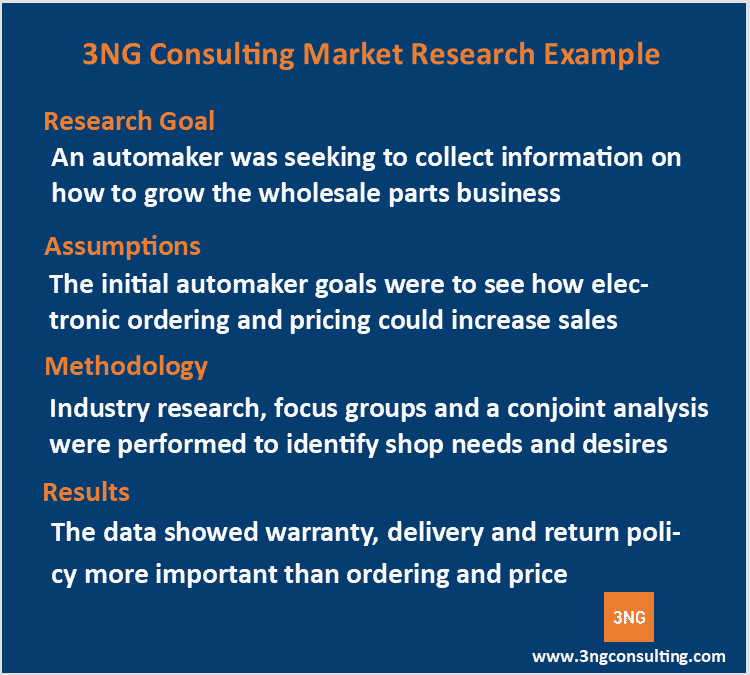

The 3NG Consulting Approach

3NG Consulting is a full-service consulting firm that offers market research services. We collect the data sets that drive success.

3NG Consulting process starts with a strategic template to set your data goals. We then build a plan to meet your goals.

We can often answer your needs with our data library. And if research is needed, our team of experienced market experts will find actionable data insights. So, call us today to get started.