EV service batteries present future challenges for OEs and dealers. These challenges are important because they are difficult to address and could undermine the sale of electric vehicles. Strategic thinking is needed now if these issues and consequences are to be avoided.

Starter Batteries Vs. EV Batteries

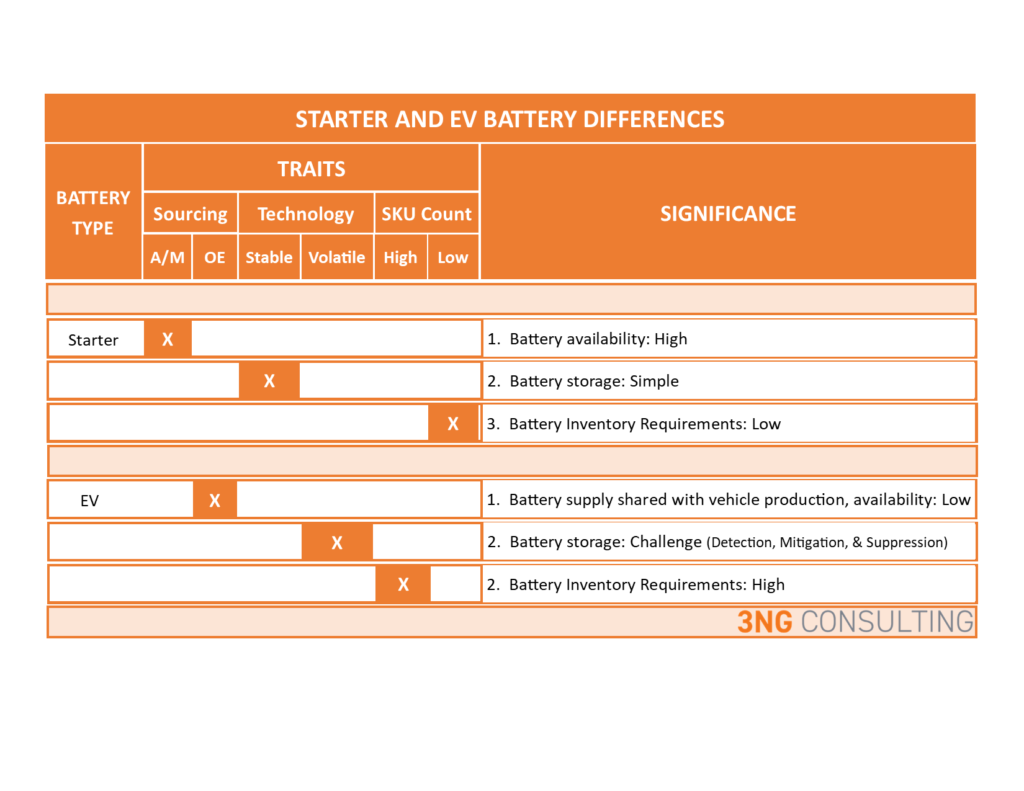

OEs’ and dealers’ primary experience with service batteries has been with the administration, testing, and selling of starter batteries. EV batteries are very different from starter batteries, as described below.

EV Batteries

Sourcing

Sourcing affects product availability and the sourcing criteria for EV batteries will limit service supply.

OE-sourced EV service batteries are produced on the same line as production batteries. OEs prioritize vehicle production over all aspects of their business. So, vehicle assembly gets sourcing priority until alternate service production investments are made.

Such investments generally take years, leaving service supplies susceptible to shortages as new vehicle production ramps up. This same phenomenon happened with certain Hybrid brands, causing the affected automakers to pursue remanufactured (reman) options for service replacement battery supply relief.

Volume reman production efforts were restricted by a lack of useable cores and a remarkably complex requirement to balance all the cells in a reman battery. Eventually, some of these efforts were abandoned.

This same scenario will affect EV batteries moving forward.

Technology

EV batteries are more volatile than lead acid batteries, making their storage and transport more challenging.

Lead acid batteries degrade over time but remain relatively stable. They are generally stored next to one another in open warehouse environments. This is how starter battery distributors are able to warehouse inventories throughout their supply chains, thus offering a steady flow of available batteries.

This is not the case for EV batteries. Rooms used to store these batteries should be:

- Isolated from adjacent areas containing combustible materials

- Clean, dry and free from sharp objects that could puncture cell casings

- Designed for full encapsulation with class D fire extinguishing powder

- Have immediate access to both class D and ADC fire extinguishers

- Able to provide a 10 foot space between batteries (only in certain jurisdictions, such a Southern California)

SKU Count

EV battery designs can vary by vehicle model, proliferating SKU counts, production challenges, and service challenges.

Aftermarket-sourced OE Lead acid batteries are deigned by group size. Based on this industry standard, a single group size can service many different vehicle applications. So, starter battery programs require only minimal Part Numbers to provide full application coverage.

Such coverage results in increased production efficiencies, low inventory needs, and simplified marketing and sales requirements. Some automakers, for example, can service 80% of their applications with just a handful of group sizes.

This circumstances changed in recent years, as OEs became more involved in the design, specification, and sourcing of starter batteries. The net effect of this change was increased cost and SKU counts, as well as limited availability. This same situation will occur for EV batteries moving forward.

EV Battery Supply Options

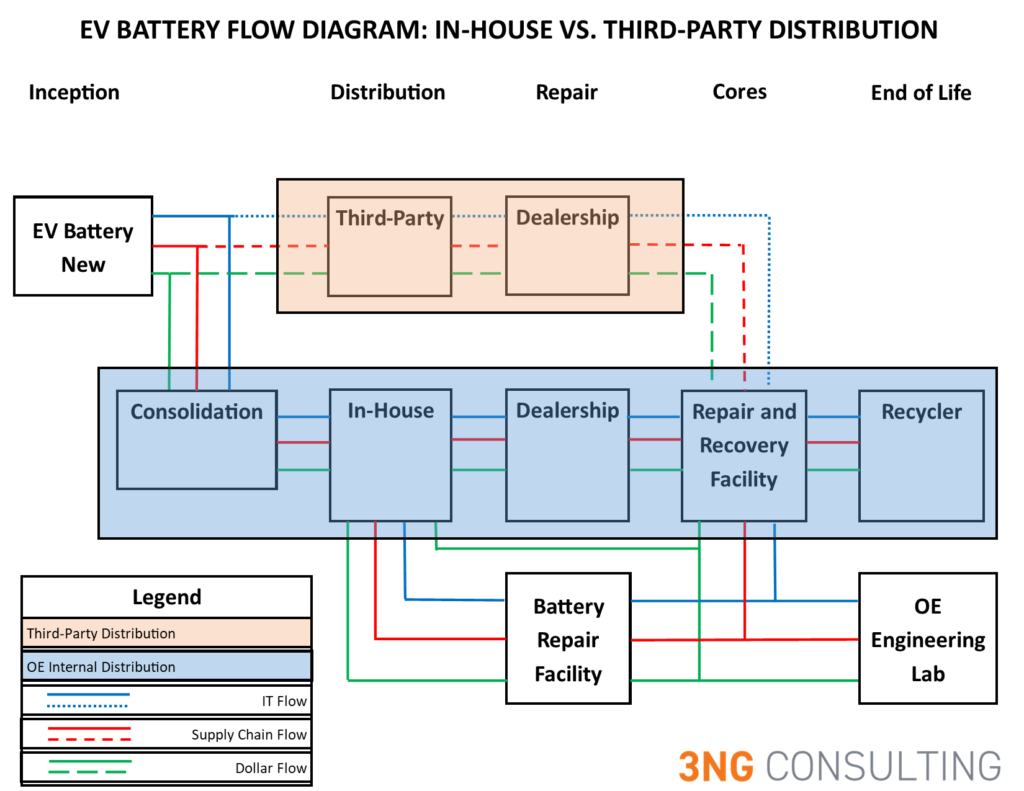

OEs need to visualize how they can best support EV battery service supply. The below chart is provided as a simple way of doing so.

The brown boxed area above shows how a third-party channel could be used to supply EV batteries. This visual is also designed to highlight the disconnect of a third-party channel without end-of-life continuity.

The blue boxed area above shows how a fully integrated in-house OE battery program could look, inception to end of life.

While OE battery programs will need to evolve over time, the above reveals some of the important factors that need to be considered along the way.

About 3ng Consulting

We are a full-service automotive consulting company. Our team specializes in fixed ops products and fixed ops consulting, as well as Channel Balancing – a process that leverages the strength of dealers, automakers and suppliers to provide a balanced channel that offers the highest possible service.

On the EV side, our team has experience helping launch new EV platforms, as well as developing processes and procedures for reman (Hybrid) battery programs.

Click here for more information on our Automotive Consulting Services, our Dealer Consulting Group and our Mobile Service Consulting Services.