OEM Auto Parts pricing strategy is complicated. And until recently, OE list prices set foundation that defined the purchase price for every customer type. In the past, this put automakers and dealers at a disadvantage when selling against aftermarket customer pricing.

Limitations of List Pricing Strategy

List pricing strategy is the traditional starting point dealers use to set pricing for each of their business channels. So, OE list prices are the base to which dealers apply cost plus pricing or discounted list pricing. List based pricing is easy for Parts Departments to manage but lacks the ability to present the right price to the customer at the right time.

Also, OE sets the premium price point in the industry. And since OE list price is published, the aftermarket uses it set their (lower) target pricing. And since OE list price also sets dealer cost, dealers don’t have enough margin to compete with aftermarket wholesale distributors.

Automaker Pricing Challenges

Using OE list pricing limits the ability for automakers to affect sales. And dealer door labor rates are expensive, so reducing part prices alone don’t make dealer service competitive.

Also, discounted list pricing makes it difficult for dealers to capture the wholesale mechanical business. And dealers’ poor delivery and response time makes it difficult to capture the additional business. The result – dealer margin increases transfer profit from automakers to dealers without enough sales lift to justify the additional discounts.

Not Enough Margin for Wholesale

Shops get a larger gross when buying wholesale parts from the aftermarket than from dealers. And current OE pricing structures don’t allow dealers to increase shop margins and remain profitable.

The obvious solution seems to be for automakers to provide dealers with a larger margin. And for the dealers to use that margin to increase wholesale sales. Unfortunately, this doesn’t typically work out this way. Instead, dealers make a lot more parts margin in the service department and only see a small increase in wholesale sales.

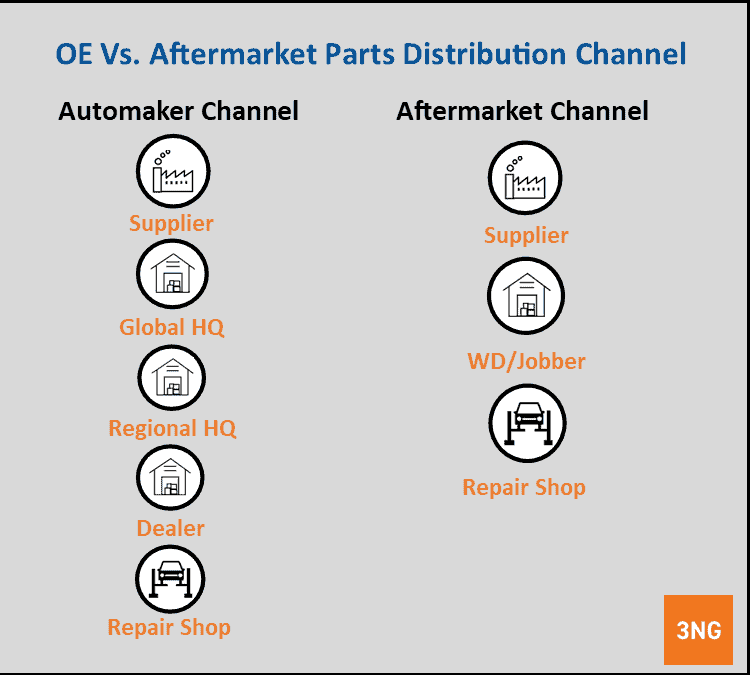

Complicated Supply Chains

Automakers are disadvantaged by an expensive supply chain. The aftermarket has removed the independent jobber from their distribution channel while automakers still have independent dealers in the supply chain.

The aftermarket can use their short and integrated supply chain to implement target pricing strategy with minimal channel conflict. On the other hand, automaker pricing strategy depends on the dealer cooperation which can have mixed results.

Also, because aftermarket channels are shorter, they add less cost and more value than automaker supply chains. This allows aftermarket distributors to sell parts at a lower price and a more consistent service level than dealers.

Technology Offers New Opportunity

The advent of SaaS based sales platforms gives automakers the ability to compete 1:1. This changes the game by helping automakers to cater to each customer base on equal footing with the aftermarket. And because technology is fast and flexible, automakers have the opportunity to create channel-based pricing strategies.

Modern systems allow automakers to apply instant pricing for highly targeted dynamic pricing strategies. This allows the automakers to increase sales and profits by price skimming when possible and lower pricing when needed.

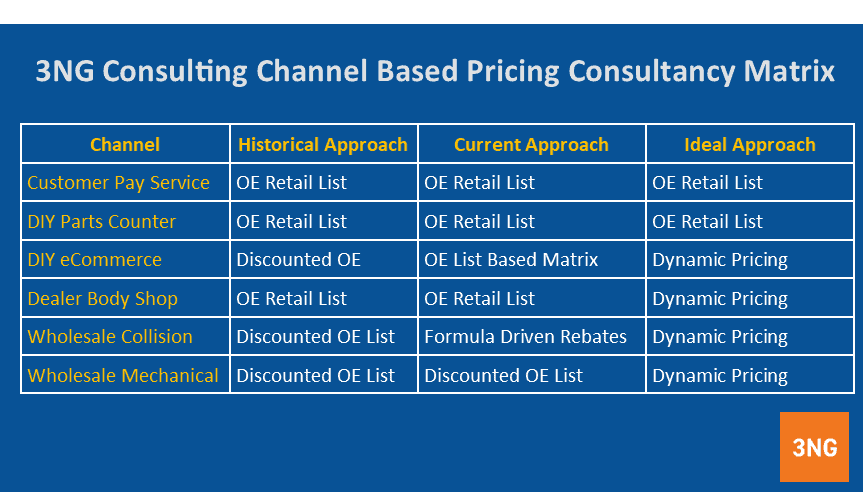

Targeted OE Pricing Strategies

One price doesn’t fit everyone, and static pricing models don’t deliver results for all customers. List pricing is very effective at balancing profit and revenues for the Parts Counter, Service Drive and Collision Parts marketplace.

Unfortunately, list-pricing based strategies fail to capture the largest growing markets – Mechanical Wholesale and DIY eCommerce. 3NG Pricing Strategy consultancy helps automakers maximize fixed operations sales and profits by helping develop highly targeted pricing strategies.

And, systems such as RepairLink, Microcat Parts Bridge and SimplePart automakers to their product pricing strategies by customer channel.

Walk-in Customers

List pricing is for walk-in customers. OE list is the industry high price level. This allows dealers and automakers to maximize revenue and profits during the early stages of the vehicle lifecycle. And list pricing should remain the benchmark for OE customers as it allows automakers and dealers to maximize sales and profits.

DIY ECommerce

Let’s face it, dealerships don’t have the same parts retail presence as the aftemarket. Dealer locations are inconvenient for parts buyers while aftermarket jobbers are seemingly on every corner. So, DIY eCommerce presents a huge opportunity for the OE Supply chain to reach beyond the Parts Department to increase DIY sales.

Selling parts over the internet is very competitive and selling on the web with list-based pricing isn’t effective. Instead, DIY eCommerce is a perfect venue to implement dynamic pricing using historical transaction data. If used properly, dealers and automakers can establish economy pricing over the internet without damaging dealer walk-in margins.

Wholesale Mechanical

Wholesale auto parts represents the greatest opportunity for fixed ops growth. With less than 5% of a $138B marketplace, wholesale mechanical represents the largest opportunity for dealer growth. Unfortunately, the OE supply chain limits the effectiveness of traditional pricing actions.

Instead, dynamic pricing models implemented in electronic ordering systems can use historical sales data to create customer specific pricing. And since this pricing is set by customer type, automakers can use rebates and dynamic pricing models to inspire every customer to buy now.

Pricing Strategy Examples

3NG Consulting has a multi-channel approach for automakers. Our pricing consultancy services help automakers use modern tools to maximize sales and profits. Our program uses economy pricing when necessary for sales capture and higher pricing, when possible, to maximize revenue.

The table below shows our targeted approach by sales channel. And since our approach our solution can be used in the United States or anywhere across the global supply chain.