Setting BEV Customer Service Expectations

Vehicle Technology Defines Service Industry

BEV service strategies are already being shaped, well before the technology reaches critical mass.

Current estimates suggest that BEVs will account for 30% of new vehicle production by 2032. If this estimate holds, BEVs will account for just under 10% of total US Units in Operation (UIO) by 2032.

The gradual mixing of BEV technologies into the US fleet will eventually:

- Shrink the total service market

- Make it even more competitive than it is today

But this transition will take time, and there is much to learn along the way.

Automakers and dealers are currently building the technical and physical infrastructures needed to service BEVs. Most independent aftermarket shops will not follow suit until 2032 or later.

So, dealers are currently in the driver seat. They have the:

- Mandate

- Traffic

- Training

- Equipment

While it is still too early to divine the future of BEV service strategies, dealers are providing insights that deserve ongoing reflection.

Is Past Really Prologue?

BEVs provide an opportunity for dealers to retain customer service business longer than the traditional 0 to 7 years.

Parts and service gravitate to areas of need, or opportunity. Some of this opportunity is inevitable, but much of it comes from unintended consequences, as exampled by:

- Inevitable: The Internal Combustion Engine (ICE) gave rise to countless product and service opportunities

- Unintended: Dealer (ICE) emphasis on high-margin warranty and diagnostic work provided the aftermarket a maintenance focused inroad

Dealer retention rates for ICE vehicles is about 20%. But for BEVs, the number is just under 90%. This means that dealers are getting a running start at:

- Performing general BEV maintenance services

- Diagnosing and fixing more complex issues

- Quantifying BEV service revenues Vs. costs

- Offering unique, value-added BEV services

It also means that dealers are positioned to set BEV customer expectations, at least for early adopters. Historically, dealers have not been in this position, as they relinquished most maintenance business to the aftermarket decades ago.

Giving up general (ICE) service business caused the aftermarket to dominate the maintenance market. Today, most ICE maintenance work, regardless of vehicle age, is performed by an aftermarket shop. Dealers can now change this dynamic, and BEVs provide a path for doing so.

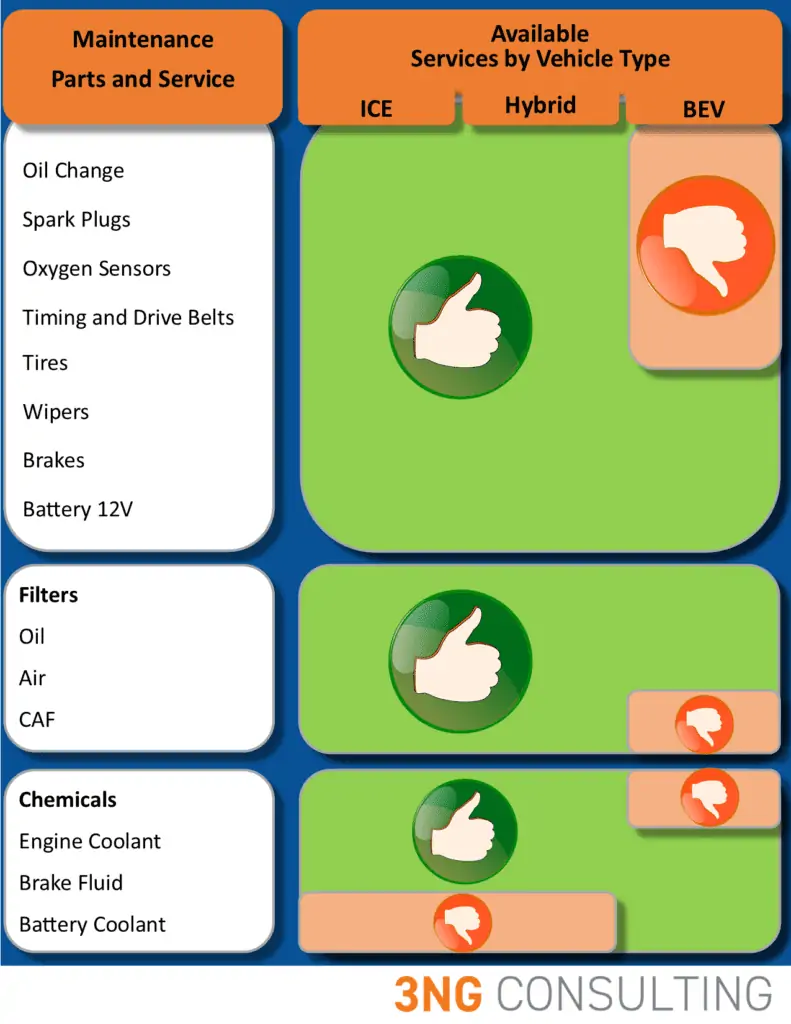

ICE Vs. EV Maintenance Requirements

BEV Service Strategies

General

The above differences are significant and important. There is less maintenance to perform on BEVs. There are also fewer moving parts, meaning less to go wrong. So, diagnostic work will also decline.

BEVs are expected to account for approximately 43% of dealer service business by 2032. This is why BEV service strategies are so critical. And why it is so importance to get BEV maintenance services right.

Deliberate BEV service strategies will:

- Drive traffic

- Satisfy customers

- Generate profits

Random BEV service approaches run the risk of:

- Misplaced investments

- Competitive challenges

- Declining profits

Current Situation

Dealers that are already investing in their BEV infrastructure will have a competitive advantage moving forward. But the best way to sustain this advantage is by offering customer-centric service packages.

Dealer investments, on average, amount to approximately $250,000 per shop for BEV-related architecture. Areas of investment include:

- Chargers

- Infrastructure (Electrical supplies, etc.)

- Training

- Equipment

- Point of Sale Materials

BEV service revenue potential is currently insufficient to support such investments by all dealerships. Expectations are that it will take another 7 or 8 years before all dealerships are able to take the leap. So, it is up to a small subset of dealers to find the service experiences that work for BEV customers.

Most independent aftermarket shops will be hard-pressed to make similar investments for quite some time. This is due to the limited number of BEVs they are expected to service over the next 10 years. Sustained dealer BEV retention will further extend their investment horizon.

So, dealers are making the necessary financial investments. But what about service strategy investments? Initial feedback suggest that dealers get it. Currently, many BEV dealers are developing:

- Mobile service options (For re-flashing and basic BEV maintenance services)

- Dedicated bays for BEV servicing (Ensuring that space, equipment, and trained technicians are available to service current BEVs)

- Battery servicing protocols (Replacing battery cells/ arrays and rebalancing the unit for optimized service life and efficiency)

- Service value-adds (Battery recharge services)

Re-Thinking Basic Service

We at 3ng Consulting believe that BEV customers will be looking for more than just a mobility platform. They will be purchasing an ownership experience. Vehicle features are definitely part of this experience, but so is the way in which “the platform” is supported.

Automakers and dealers that want to increase their share of BEV sales must provide an exceptional ownership experience. This means dealers will have to shape their basic service offerings around customer needs.

Considerations must be made for:

- Convenience

- Speed of service

- Cost of ownership

There are different ways to package this, but dealers have to find a balance between the above 3 considerations.

Mobile service will definitely be part of the offering. Some dealers are already outfitting their mobile units for BEV support services. These dealers seem to be getting little direction from their OE partners, who are letting dealers define the details.

Click here for information on what to look for in Mobile Service

Automakers and dealers will also need to find ways to service battery issues in the fastest, most economical way. Having a dealer remove a battery, replace and rebalance its cells, and then re-install and re-calibrate it, is probably not the most customer-friendly approach.

This is where OE priorities can adversely effect BEV repair services and customer expectations. New battery production is primarily designated for new vehicle builds. Excess production is then re-routed for parts and service.

But the desire to produce more and more new vehicles, decreases the flow of service batteries. In the end, OEs find it difficult to support service demand. They then burden suppliers and dealers with initiatives to repair or refurbish batteries. Such efforts serve to dissatisfy customers and empower the aftermarket.

So, dealers are going to have to determine what customers want and how they are going to deliver these basic services. Some dealers are already working to figure this out. But automakers will have to find a balance between their desire to build more and more BEVs and their ability to service the ones already out there.