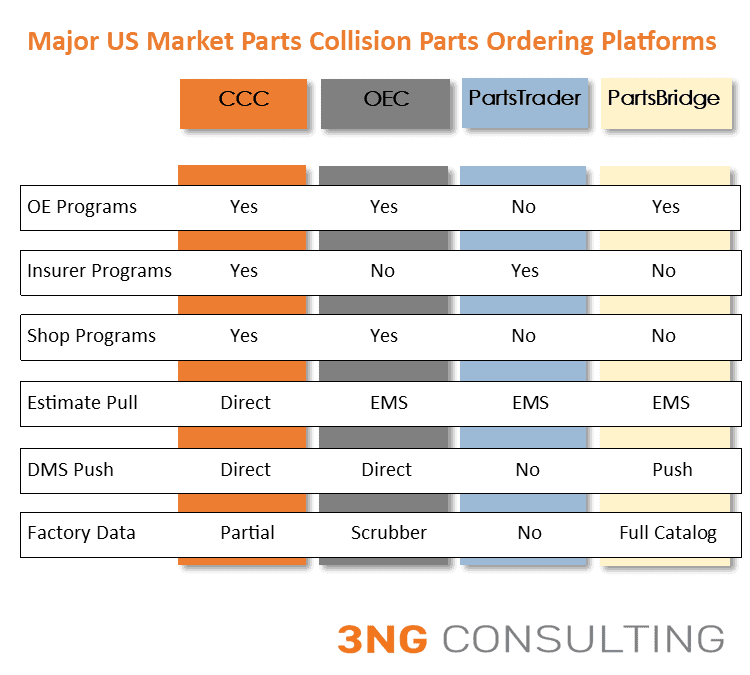

The Collision Parts Ordering marketplace has become a lot more interesting. Could OE Connection’s recent acquisitions establish OEC as the dominant platform for auto body parts ordering. Or will CCC continue to grow to dominate the collision repair industry?

The Market Leaders

OE Connection and CCC One are locked in a battle for the market. OE Connection’s first to market was able to build a strong position. Not to be outdone, CCC added replacement parts ordering to their dominant estimating platform.

CCC’s pursuit of OE programs has set the battle was set for the market. However, recent acquisitions by OE Connection could level the playing field and change the battle for the number 1 market position.

CCC Market Position

CCC has built the most complete and widely accepted auto body shop management platform. They start with over 50% of estimates volume and feed those estimates into a complete set of collision repair tools, This offers shops and part suppliers an end-to-end market solution.

This ecosystem includes everything a shop needs to repair a vehicle from estimating, Claim Management, repair information, post-repair inspection and parts ordering. And CCC has sold this position to automakers, body shop groups and insurance companies.

OE Connection Market Position

OE Connection was the first company in the market to offer electronic collision parts ordering. OE Connection was established with the mission to automate collision parts ordering for original equipment parts.

With nearly a decade head start on the competitors, OEC captured contracts with nearly every automaker in the US and Canada. With multiple recent acquisitions, OEC now has the tools to match CCC. But can they compete?

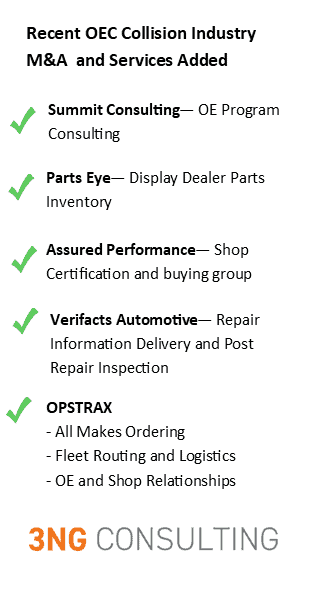

Recent OE Connection Acquisitions

OEC has responded to the recent CCC by acquiring companies to expand their capabilities. Some of the noteworthy acquisitions have been

- Summit Consulting– Automaker consulting and wholesale CRM tools

- PartsEye – Dealer Parts Locator and inventory liquidation and management

- Assured Performance – Independent shop certification and buying group.

- Verifacts Automotive – Post-repair inspection and information delivery

- OPSTRAX – Fleet dispatch, multi-channel ordering and OE and body shop chain contracts.

CollisionLink Collision Enhanced Parts Ordering Opportunity

Once integrated, OE Connection will have the features to match CCC. This gives OEC the opportunity to offer automakers a product set with unique capabilities and solutions.

- Dealer and Shop Consulting: OEC can offer dealer and independent shop certification programs.

- Parts Locater Business: PartsEye adds brands and capabilities to D2D Link

- Post Repair Inspection: OEC can offer post-repair inspection using the VeriFacts tools

- Fleet Management: OEC can offer dealers fleet management through OPSTRAX

- All Channel Ordering: OPSTRAX gives OEC access to the salvage and aftermarket channels.

- Shop Buying Group: A registered buying group that legally consolidates collision center buying power

CCC Market Position

CCC has market momentum and is adding clients and market share. Their shop first approach has allowed CCC to offer a complete solution for repair shops. This includes estimating, shop management and parts ordering. This shop first approach has helped CCC capture OE business from OEC and body shop business from OPS.

Some unique features CCC offers include:

- Repair Data Delivery: The ability to provide repair information and trouble codes to the vehicle at the time of repair

- Visual Inspection: The ability to use an AI tool to identify damage and prepare a visual damage estimate

- Vehicle Scanning: Tools that allow shops to certify that all electronic systems have been returned to pre-loss condition

- Shop Certifications: The tools and programs needed to manage independent and dealer shop certifications

- Body Shop Management: Body shop workflow management including parts ordering, technician scheduling and job management tools.

Remaining Gaps

Auto body repairs have efficiency issue associated with incomplete and inaccurate estimates. And while the cause of these issues is different, the net result is the same – shops waste time fixing errors that could be eliminated with better parts data.

The potential value to shops and the supply chains are significant and OEM Part Catalog publishers such as Infomedia and Snap-On can provide the OE data necessary to improve the estimating process.

Tipping the Balance of Power

Reducing the number of full-service parts ordering systems from 5 to 2 change the balance of power in. But who will benefit most? Will it be automakers, insurance companies, shops and part suppliers.

Are you interested in discussing what the recent moves by OE Connection mean to your business? Find out more about our consulting services and schedule time to talk and we can share our thoughts about this acquisition.