Why Automakers Outsource

History of Auto Parts Outsourcing

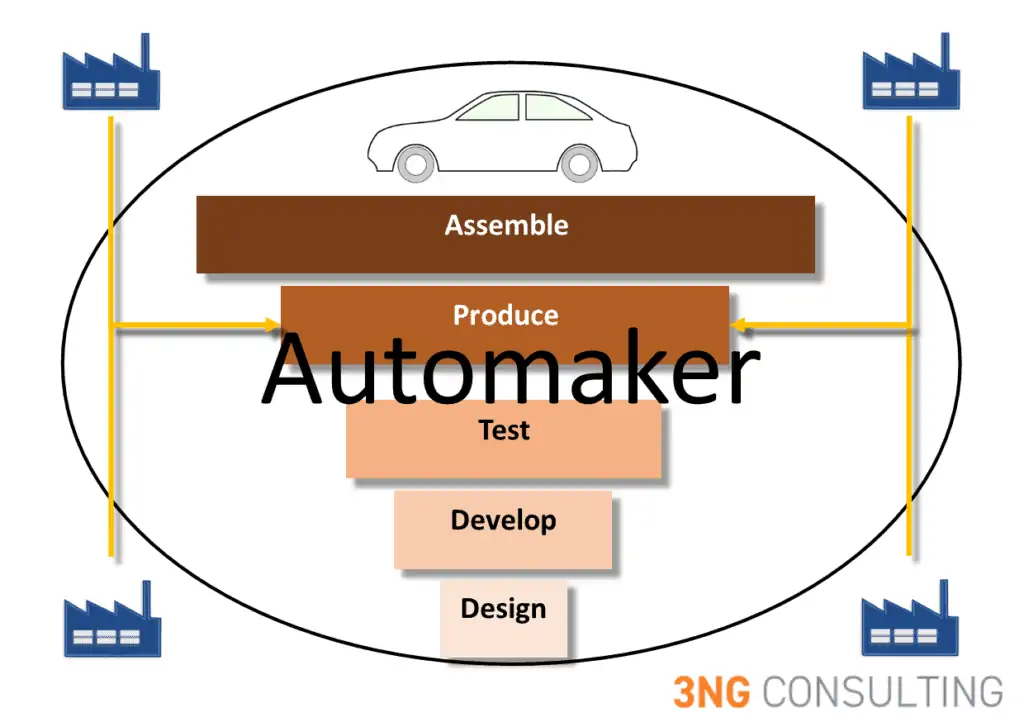

The amount of automaker parts outsourcing varies by brand, model, and geography. On average, anywhere from 30% to 100% of vehicle parts are outsourced. Some automakers even outsource the assembly of certain vehicle models.

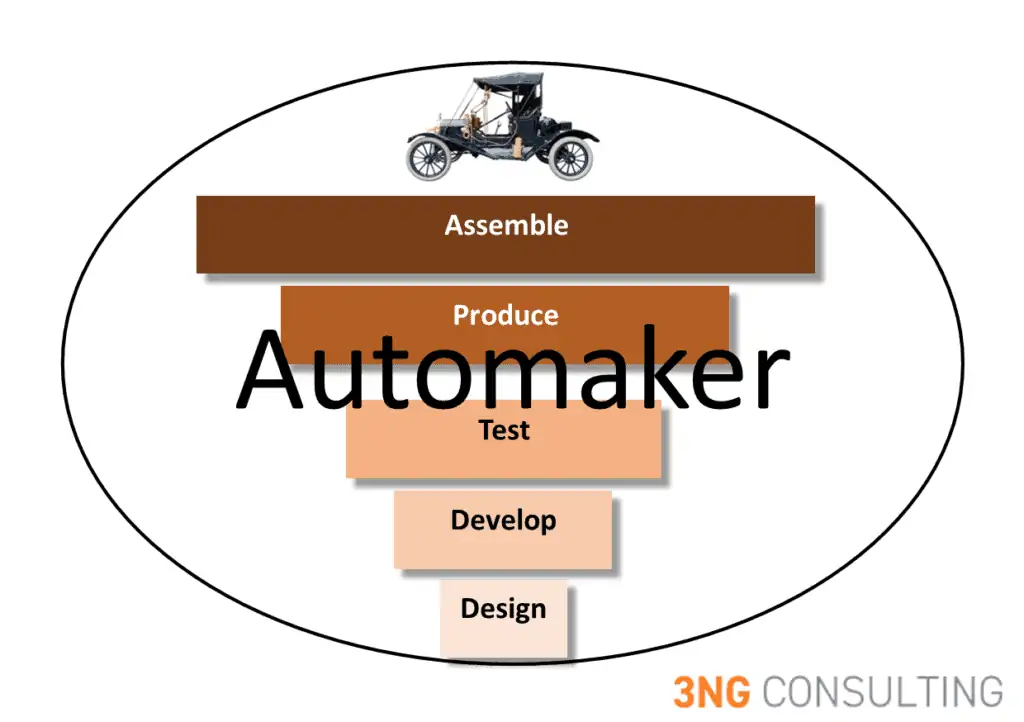

Modern automotive supply chains have little in common with the systems that historically supported vehicle manufacturing. Automakers once built every component used in their vehicles. This practice was considered instrumental in:

- Ensuring product quality

- Optimizing supply chains

- Simplifying and minimizing warranty

Today, automotive supply chains are much more diverse and complex. This is because of the auto industry’s ongoing desire to “vertically disintegrate” or “fragment”.

Outsourcing is not just a purchasing decision. The practice has three primary drivers:

- Reducing wage and benefit costs

- Mitigating demand volatility

- Accessing specialized skills without having to develop them internally

The benefits of Outsourcing Auto Parts

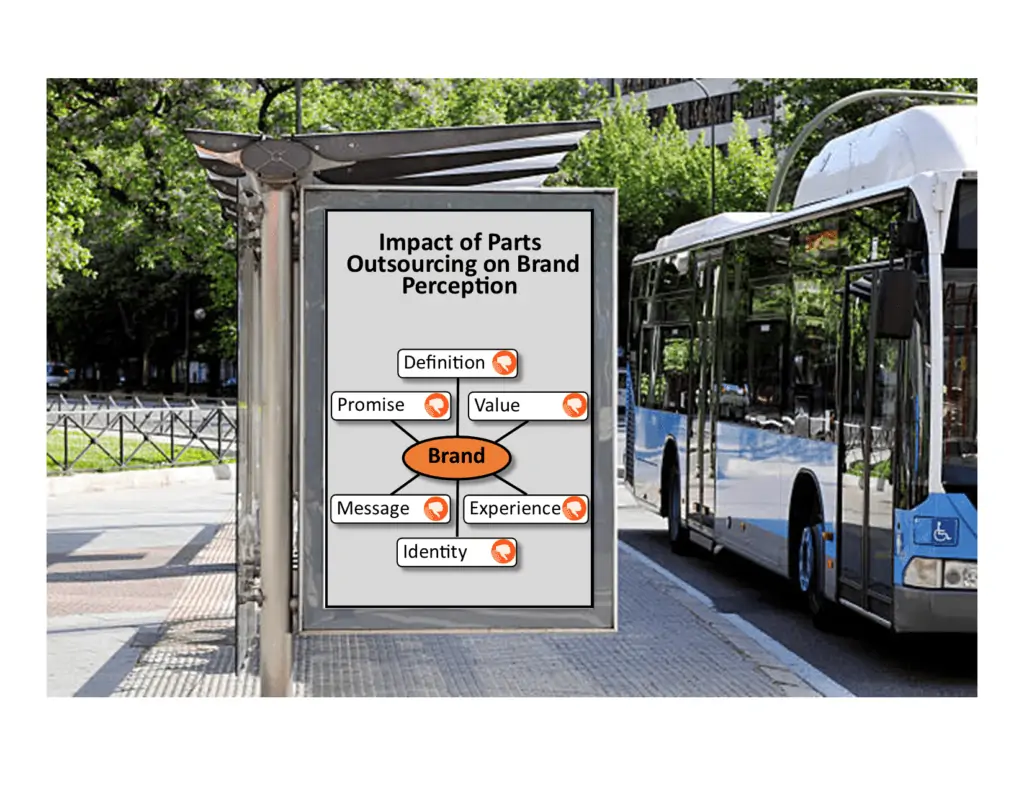

Outsourcing allows automakers to emphasize product sales, service, and ownership support. These activities are strategic because they build brand perceptions and secure future sales.

The outsourcing of auto part production benefits automakers greatly. It allows them to acquire parts faster, better, and at a lower cost than if they’d built them themselves.

Because of outsourcing, automakers are also able to run very lean in terms of head count. The majority of automaker associates are tasked with managing things (relationships, programs, and processes) rather than building things.

Indeed, the majority of associates on the fixed ops (parts and service) side of the business are responsible for supply chain management. They manage deliveries and backorders in order to satisfy product demand. The remaining associates are there to influence, either directly or indirectly, the customer ownership experience.

So, automaker emphasis on outsourcing has been both lucrative and strategic. It is the foundation upon which the modern automotive industry has been built.

The Downside of Auto Parts Outsourcing

Outsourcing is becoming riskier, even while while its popularity grows.

Declining transaction costs during the 1990s gave rise to an outsourcing explosion. But as this trend continues to increase, so do the risks.

As supply chains extend globally, they become vulnerable to many influences, including:

- Natural Disasters

- Labor Unrest

- Political Strife

- War

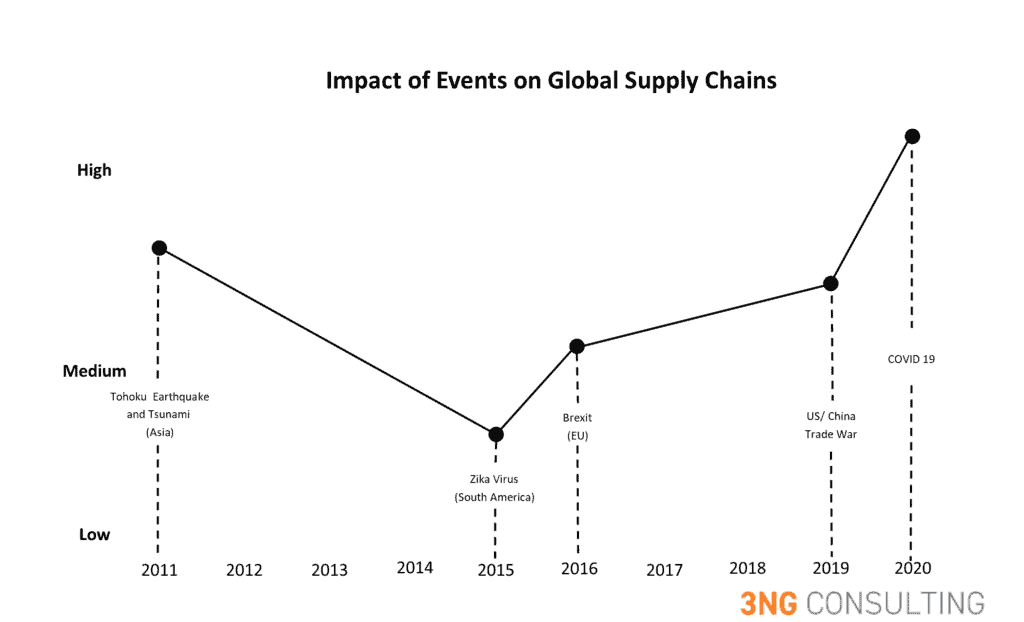

While COVID is the topic du jour, there are other examples of recent supply chain disruptions. An abbreviated list looks something like this:

While COID is the topic du jour, there are numerous examples of recent supply chain disruptions:

- Tohoku earthquake and tsunami (2011)

- Zika virus spreads across South America (2015)

- Brexit vote (2016)

- US Trade War with China (2019)

- COVID 19 (2020)

Right now, such work is extremely difficult. Subcomponent manufactures are not able to find raw materials. Parts producers are not able to obtain subcomponents. And automakers

The above list is not comprehensive. It is simply offered as a way of representing the different volatilities that create supply chain issues.

Many of these events produced multi-year impacts, generating incremental supply chain stress. Managing these pressure points requires discipline and careful consideration. (Click here for a description of Toyota’s actions after the 2011 tsunami.)

Current supply chain stresses are unprecedented. They are impacting new and used vehicle availability, as well as parts and service flow throughs. The impact may not be hitting automakers’ bottom lines, but it is having an effect on brand perceptions. This could have a long-term, negative impact on certain car companies.

How Automakers can Protect their Supply Chains

The Toyota example is good but it also shows the limitations of existing countermeasures. Toyota identified chips as a vulnerable part, but the actions it took did not immunize the company’s supply chain from the effects of COVID.

It is clear that more must be done. If outsourcing remains the preferred strategy, then contingency plans have to be developed. Companies have to spread their risks across different geographies, partnerships, and transportation platforms.

This will require investments that could soften the benefits of outsourcing. But at the end of the day, automakers will have to calculate the amount of risk they are willing to assume. And the answer to that question will likely come from the COVID shortage fallout.