Overcoming the Psychology of Not

Automakers and Dealers Think They can’t Compete

Automaker and dealer part growth is a function of vehicles sold and customers retained. Unfortunately, most automakers and dealers only succeed in pushing one side of this equation: vehicle sales. The other, customer retention, remains a focus, but the numbers fail to improve.

The fact that retention rates do not change feeds the belief that dealers are unable to compete with the aftermarket. This belief is as flawed as the efforts used to impact retention rates.

Automaker service and parts executives are exposed to a host of challenges based on rapid market, regulatory, demographic, and technological shifts. The pace of these changes requires ongoing strategic thinking, followed by decisive action.

But automakers are ill-equipped to do this. While there is never a shortage of ideas or options, basic psychology prevents them from exploring even the good ones. And without bold action, automakers and dealers will not achieve their retention goals.

Discounting Competitive Advantages

Beliefs govern thoughts and actions. This is true in our personal lives. It is also true for organizations.

Restricting thought and actions within an organization is described as “Risk Management”. While risk always needs to be assessed, defined, and considered, it should never paralyze an entire organization.

The most popular cure within automakers for risk is doing nothing. But organizations cannot stay relevant if their pathology is only to manage the status quo.

If an organization believes it can’t compete it won’t. And so it is with automakers and dealers. Their doubt distracts them from the things they need to do and the decisions they need to make to be relevant.

Explaining the Mindset

Why does this happen?

Automakers run lean, at least in terms of staffing. This means that bold actions or big initiatives are always weighted against the amount of time and effort needed to implement them. Add to this the belief that the impact will be risky and you have a recipe for inaction.

Not every idea is good, of course, but ideas are the fuel that makes organizations thrive. They should be evaluated on their merits, not on how much time or effort they require. The good ideas should be pursued, the bad ones rejected.

But in the automotive world, automakers and dealers rarely consider bold initiatives. So, they rely instead on new vehicle sales — instead of operational advancements — to drive service traffic and keep them relevant.

In this way, even good ideas fall victim to the phycology of not.

The Results of Doing Nothing

When it comes to part growth there are two basic requirements:

- Increasing customer service traffic

- Providing a quality service experience

These two requirements are easily understood but difficult to address in a “do nothing” environment, as the below examples show.

Potential Part Growth Contributor: OE Oil Programs

OE Oil Program part growth is muted because of a lack of program support.

Automakers partner with suppliers to develop and produce private-label parts for their assembly lines. They then extend these contacts to include service and parts supply. This way, research and development costs are amortized over a longer product life cycle.

While this approach benefits parts suppliers, OE purchasing departments, and new vehicle production, it does little to benefit parts and service. Consider the oil business.

OE oil suppliers spend considerable time and money developing next generation engine oils. Once developed, they obtain near exclusivity in supplying factory oil, which is relatively simple:

- Quantity requirements are calculated in advance based on vehicle production plans

- Delivery schedules are planned accordingly, also well in advance

- Production is then aligned with delivery dates

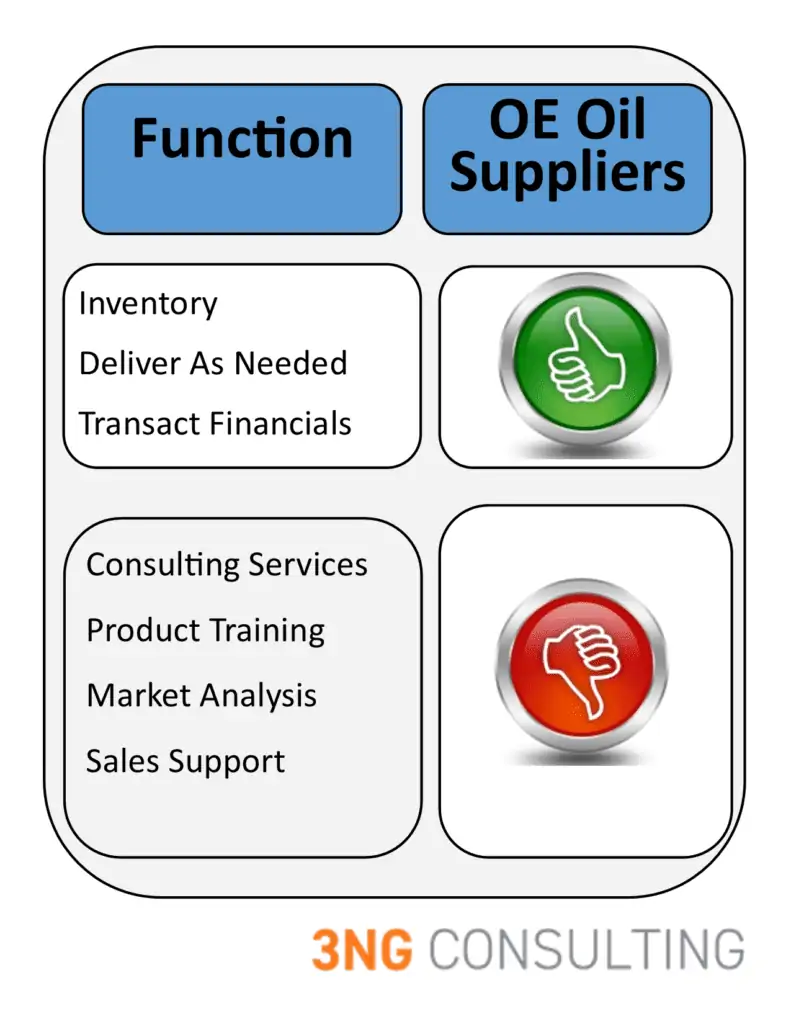

OE oil suppliers are well-suited to support these business requirements. But the service and parts business is very different, requiring competencies that go well beyond the ones listed above.

The above chart shows that most OE Oil Program suppliers are able to deliver product but not support parts and service. This means that:

- OE Oil Program offerings is limited to product

- Dealers see little value in this offering, incentivizing them to find better pricing locally

- Automakers try to add value by paying for third-party assistance that is too broad to help with oil

All these consequences lead to a simple outcome: most dealers provide an inefficient oil change service that customer dislike. Given that oil changes are the most repetitive service customers need, this outcome is bad for retention.

To fix this, automakers have two options:

- See that their oil supplier acquires the needed competencies

- See that they acquire a new oil supplier

But the risk, time, and resource factors that automakers use to evaluate projects like this prevent them from implementing either option. So they simply live with the status quo and miss their customer retention objectives.

The results of Doing Something

Potential Part Growth Contributor: OE Tire Programs

Dealers successfully compete in the tire business but part growth is still muted. This is because the tire support they get does not extend to peripheral parts or related services.

Tires are a very unique product line. Automakers contract with tire manufacturers to develop and produce branded tires for vehicle assembly. They then allow them to sell these same branded tires throughout the aftermarket.

Like the private-label parts example above, this approach benefits tire manufacturers, OE purchasing departments, and new vehicle production. It does not benefit OE parts and service.

Historically, dealers did not even sell tires. The product was just too complicated, requiring:

- Consistent fill rates

- Inventory support

- Product knowledge

- Retail skills

- Warranty and road hazard support

Automakers were not involved, either. Some owner manuals instructed customers to call the tire manufacturer whenever they needed tire assistance. In some cases, they even provided the phone number.

Like the oil example above, these policies drove customers into the aftermarket. So, aftermarket shops did not capture customers by outperforming dealerships; automaker and dealer policies pushed many customers into the aftermarket.

Automakers recognized their retention problem and developed tire programs in response. Building a program where none exists is easier than fixing a failing program, so automakers were willing to invest in tires. But, to do so successfully, they had to lean hard on their chosen suppliers, as shown in the below chart.

OE tire program administrators offer more support than any other OE parts or service supplier. This has allowed dealers to capture significant (tire) market share, proving that they can compete when properly supported.

The problem is that automakers do not extend this support to other products, such as brakes and oil. As a result, tire sales have increased dramatically, but brake pad and oil sales have not. And retention remains an issue because, as survey data show, tires represent only one customer defection point.

Taking a Better Approach

The tire approach shows:

- Dealers can compete

- Channel partners add more value than parts suppliers*

- Addressing one shortfall does not fix the entire problem

There is no silver bullet that will cause customers to suddenly flock to dealerships. But there is a place to start. Automakers and dealers need to enhance their oil programs. The process for doing this is:

- Develop a willingness to address the problem

- Quantify specific areas of improvement

- Work with existing supplier(s) to acquire and deploy the needed support, or

- Find a supplier that already has the necessary competencies

3ng Consulting has experience in this area. We can help you define, map out, and execute your strategy. Give us a call or send us an email.