Automakers suffer from stagnating parts sales, customer retention, and customer satisfaction. One of the primary reasons for this is the limited role they assign their distributor networks.

Sales Distributors

Function and Value

Channel partners help automakers capture more business while sales distributors provide a passive service that limits success. Functionally, a sales distributor’s role is to deliver:

- The right product

- At the right time

- To the right place

- In the right condition

So, the primary responsibility of a sales distributor is to make sure parts orders are fulfilled.

The value of this service is actionable and measurable:

- Inventory carried

- Inventory turns

- Order transaction time

- Order transaction accuracy

The cost of these services is simple to calculate, and value is easy to measure. When operational improvements are made, effectiveness is assessed and adjusted in real time. In this way, sales distributors are evaluated based on operational efficiency and improvement within the boundaries of their defined role. But this narrow focus misses considerable parts and service opportunity.

Automaker Parts Distribution

Automaker distribution models facilitate the sale of high-volume parts quite nicely, but mostly obstruct broader sales goals.

Automakers manage two primary parts distribution models:

- Model I: External, third-party managed distribution (Dropship)

- Model II: Internal, automaker owned and operated distribution

Deciding which parts are assigned to each model is largely a function of a part’s characteristic, not its strategic value. So, products requiring unique storage or distribution procedures are often dropshipped, while most other parts are managed in-house.

This condition reflects the limited view most automakers have regarding parts distribution. They see it as a task to perform, rather than a strategic tool with broad objectives. And this explains the outcomes they realize:

- Most automakers make overnight deliveries. This is true for both collision parts and mechanical parts. Collision parts are generally not immediately needed, whereas mechanical parts almost always are. In this way, automakers distributor networks over-deliver sheet metal and under-deliver mechanical parts.

- Some automakers do not stock certain parts because they’re not being ordered. But they fail to realize that the parts aren’t being ordered because they’re not being stocked. This leads to lost sales and declining brand loyalty.

- Automakers select dropship suppliers solely on their ability to distribute a specific part. This results in limited program value, causing dealer defections to competitor (price-based) programs.

Channel Partners

Function and Value

Channel partners are business that do more than produce or distribute a part. They also want to help their dealers maximize the sale of their parts. So, they focus on the development and sharing of the skill sets necessary to help dealers effectively order, inventory, and sell their parts.

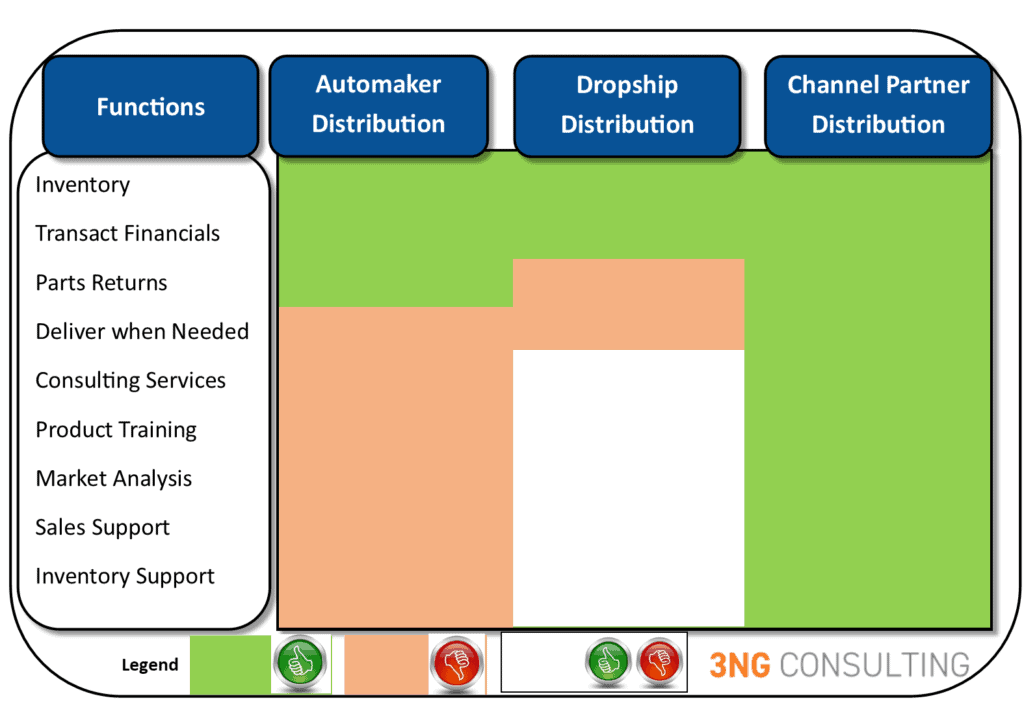

Channel partners provide an active service that directly benefits both manufacturers and customers. Compared to automaker and dropship distribution models, channel partners are comprehensive:

Automakers do, of course, offer many of the same functions channel partners extend. But there are some significant differences. Automaker support is:

- Offered through third-party programs, making them:

- Expensive

- Voluntary (Not part of normal business operations)

- Corporate, rather than retail focused

- Not integrated with a product, meaning:

- Dealers can participate while buying parts somewhere else

- Features are difficult to sustain (Bad habits return)

- Program administrator is not directly invested in dealer sales success

- Creating market disconnects:

- Automakers have a poor understanding of market and dealer needs because of the third-party barrier

- Dealers are not invested in improving program shortcomings

- Program and parts loyalty diminish

So, the value channel partners provide is both actionable and measurable. Operational efficiencies can still be assessed, valuated, and improved. But so can the effectiveness of their ground game. When inventory or sales problems arise, they are able to work with other channel partners (automakers and dealers) to identify the problem and target actionable solutions.

This approach builds dealer effectiveness and loyalty. It also leads to increased parts sales, customer retention, and customer satisfaction, the very areas currently underperforming.

Partnering among Channel Partners

The beauty of channel partner programs is that participants can work together to supply a broad range of added support. The relationship between products (such as radiators and coolant, tires and brakes) can help build channel partner alliances.

Such partnerships lead to “systems-based” approaches to product management and customer support. For example, participating dealers will have the tools and confidence necessary to capture legitimate rotor and tire opportunities every time they replace brake pads. This is not the case now.

Do Channel Partners Exist

While there are channel partnerships related to products, namely tires, there are only a handful of more widespread models. Though not common, existing examples (at Nissan and Toyota) support the concept and reveal opportunity for even broader application.

Still, most automakers adhere to traditional business models. The reasons for this are understandable yet unnecessary:

- Cultural Barriers: Some automakers prefer adversarial, price-based relationships

- Time and Resource Adverse: Building a network of channel partners is time and resource consuming

- Status Quo Oriented: Some automakers are happy with the current state of their business

- Suppliers from manufacturers or distributors to channel partners

- Programs from traditional modeling to channel partner modeling

We can work with you to:

- Find your starting point

- Develop a roadmap

- Guide you to implementation